Build Real Financial Confidence Through Practical Learning

Stop guessing with your money. Our comprehensive program teaches you the essential skills that actually matter — budgeting that works, investment basics without the jargon, and debt strategies that stick.

Explore Our ProgramMaster Money Management That Actually Makes Sense

- Create budgets that adapt to your real lifestyle and spending habits

- Understand investment options without falling for get-rich-quick schemes

- Build emergency funds systematically, even on a tight income

- Navigate debt repayment strategies that reduce stress and save money

- Plan for major purchases and life changes with confidence

- Recognize and avoid common financial traps and predatory services

Your Learning Journey Over 8 Months

Starting September 2025, we'll guide you through practical financial skills at a pace that fits your schedule and builds lasting confidence.

Foundation Building

Start with understanding your current financial situation. Learn to track spending without judgment and identify patterns that either help or hurt your goals.

Smart Budgeting Systems

Build budgets that actually work for your life. Explore different approaches and find what sticks, then practice adjusting when life throws curveballs.

Debt and Savings Strategy

Tackle debt systematically while building your safety net. Learn when to prioritize payments versus savings and how to balance both effectively.

Investment Fundamentals

Understand basic investment principles without the sales pitch. Learn to evaluate options, understand risk, and make informed decisions for your future.

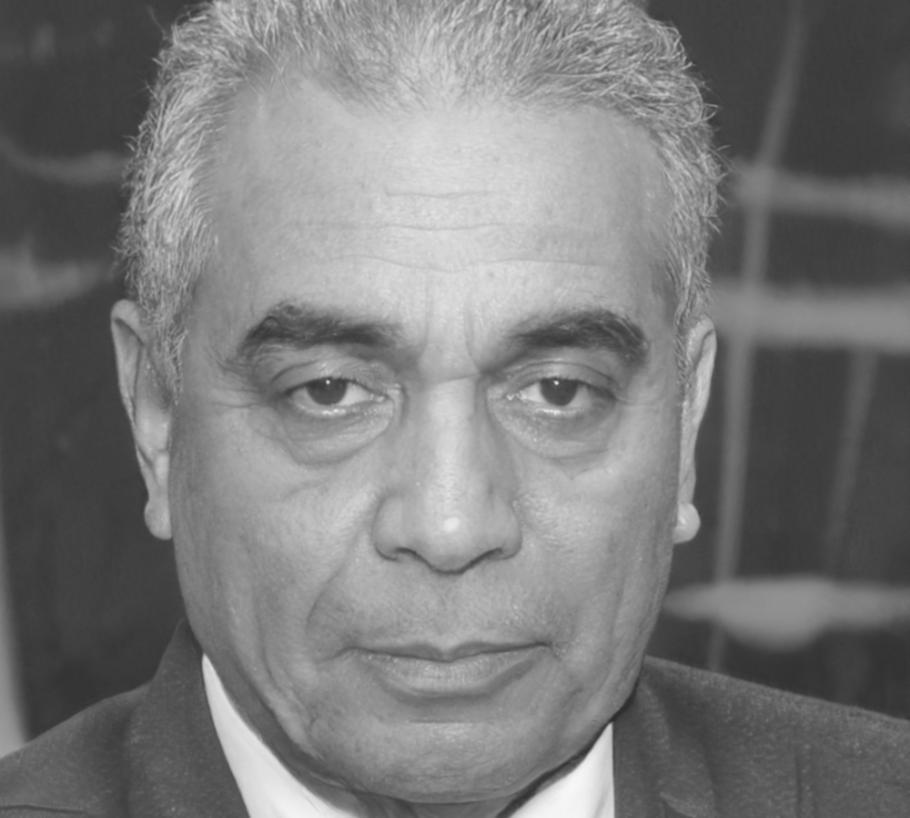

Learn From Someone Who's Been Where You Are

I spent years making expensive financial mistakes — from credit card debt spirals to investment scams that cost me thousands. Now I teach the practical skills I wish someone had shown me back then.

Marcus Whitfield

Financial Education Specialist

"Real financial education isn't about getting rich quick. It's about building systems that work when life gets complicated — and believe me, it always does."

What Our Students Often Experience

"Before this program, I was living paycheck to paycheck and stressed about every unexpected expense. The budgeting system I learned here actually works with my irregular income, and I finally have an emergency fund that lets me sleep better at night."